The purpose of the Format and Logical Control (FLC) service is to reduce the number of potential errors in parameters of trades reported by clients to the Trade Repository

Thanks to the FLC service, clients will:

- avoid or significantly reduce the number of errors in their messages and, thus, save on their costs for data recording;

- minimize the likelihood of submission of inaccurate information and meet the reporting deadlines, thus avoiding potential regulatory sanctions (paragraph 4 of Article 15.18 of the Russian Code of Administrative Offences).

Service Efficiency

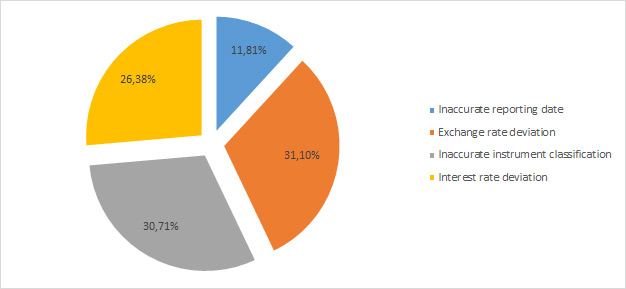

The analysis of the FLC stats for the period of December 2016 to August 2017 showed that the FLC service flagged the following types of inaccuracies in clients' messages:

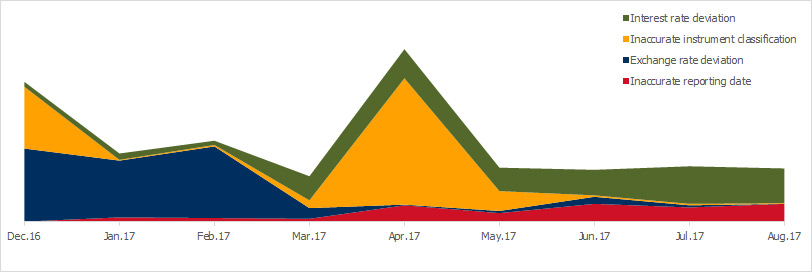

And the diagram below shows that the number of messages flagged by the FLC service was going down throughout those 10 months1:

The analysis of the messages of some clients, which were flagged by the FLC service, also shows that all clients using the FLC service send fewer messages with incorrect interest or exchange rates, and also that clients less frequently miss deadlines for reporting their trades to the Trade Repository.

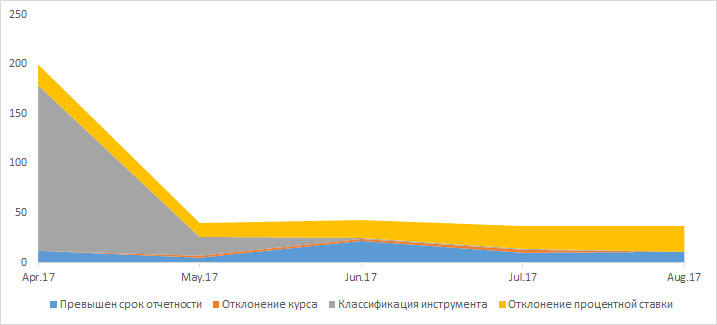

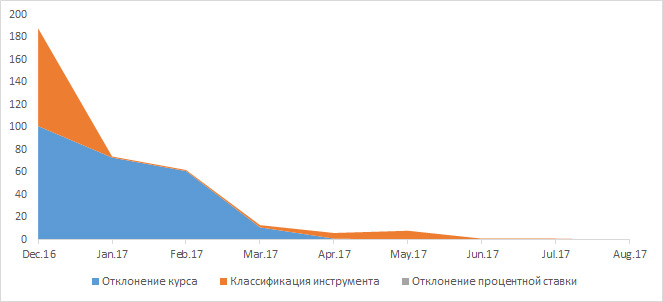

Below is the anonymized data for two companies, describing the inaccuracies in their messages flagged by the FLC service:

Company 1

Company 2

In the circumstances where failure to comply with the legal requirements as to the reporting completeness, accuracy and deadlines may result in an administrative fine of up to RUB 500,0002, the FLC service allows clients to reduce to a minimum the most common reporting errors.

NSD recommends that all clients, regardless of the number of trades they report, sign up for the FLC service. The FLC service is fully automated and does not affect the process of data reporting to the Trade Repository.

1 The increase in the number of inaccuracies flagged by the FLC service in April was due to new participants signing up for the service.

2 paragraph 4 of Article 15.19 of the Russian Code of Administrative Offences.

FLC Service Features and Functionality

The FLC service uses 'soft' checks that do not affect the process of data recording in the Log of Incoming Messages and Contracts Register. A message that has failed any FLC check is marked and can be viewed and analyzed by the client. The client is also notified of what check has been failed by the message.

Currently, the FLC service performs checks with respect to the following:

- Reporting dates

The date (operational day) when the reporting forms are to be recorded in the Log of Incoming Messages must not be later than the trade date by more than 3 business days.

See the detailed description.

- Trade type (derivative trade or non-derivative trade)

Derivative classification codes are checked:- For СМ022 fxSingleLeg (foreign exchange spot or forward transaction)

- For СМ043 bondForward (bond forward)

- For СМ047 equityForward (equity forward)

- For СМ051 commodityForward (commodity forward)

Condition: if Settlement (Delivery) Date – Trade Date =>3 business days, then the derivative classification code is not NONREF; otherwise, the Trade Repository sends the following message: «…This contract may not be classified as a derivative trade».

- Interest or exchange rate deviations

If, for an instrument, the interest rate may be calculated based on the transaction values in legs 1 and 2 of the transaction, and provided that the transaction values in both legs are in the same currency, the actual interest rate must not deviate from the interest rate so calculated by more than 0.1%.

For forex instruments, the settlement exchange rate for legs 1 and 2 of the transaction is compared to the Bank of Russia's official exchange rate of the relevant foreign currency, and an exchange rate deviation within 10% is permitted.

Checks are performed by the FLC service for the following trade types:- СМ021 fxSwap (foreign currency swap);

- СМ022 fxSingleLeg (foreign exchange spot or forward transaction);

- СМ023 fxOption (foreign currency option).

In addition, all reporting forms are checked for:

- whether or not the regulatory deadlines for recording messages in Section 1 of the Contracts Register (Messages Log) are met; and

- whether or not the regulatory deadlines for recording messages in Section 2 of the Contracts Register are met.

Special checks also apply to certain contract types:

- Check of a repo interest rate.

- Check of amount or quantity parameters.

- Check of parameters that affect the calculation of the trade volume.

- Check of the format of the data entry containing an interest rate.

- Check for whether the price of the security is different from the market quotation.

- Check of the settlement date against the bond redemption date.

- Check for whether there is a duplicate message.

- Checks for whether the reporting deadlines for CM093 and CM094 reporting forms are met.

- Check for whether the reporting deadline for a Mark-to-Market Valuation Reporting Form (CM094) is met.