NSD offers services to issuers of corporate, federal, sub-federal, and municipal bonds in the course of their primary offering and trading in the secondary market. In particular, NSD provides the following services:

- Keeping record of rights to certificated bearer bonds and mandatory centralized safekeeping of a certificate of a bearer bond issue.

- Maintenance of an issuer's issuer account.

- Maintenance of an issuer's treasury securities account.

- Bond transfers to/from clients' securities accounts in connection with their on-exchange or OTC trades, including trades made as part of a bond offering or further trading.

- Processing of payments of bond coupon income and redemption proceeds.

- Processing of put-options and buy-backs by bond issuers.

As part of its services, NSD maintains electronic data interchange with the issuer (in accordance with their EDI agreement).

Bond transfers to/from securities accounts may be made as follows:

- Transfers on a 'delivery versus payment' (DVP) basis in the course of on-exchange offering and trading.

- Transfers on a 'delivery versus payment' (DVP) basis in the course of OTC offering and trading.

As the depository responsible for mandatory centralized safekeeping of certificates of certificated bearer bond issues, NSD transfers cash funds received from the issuer in discharge of its obligations to bondholders to NSD's clients (for bonds with a state registration or identification number assigned after 1 January 2012).

NSD's bond issuer services (safekeeping of securities certificates and record keeping of rights to securities by opening and maintaining an issuer's issuer account/treasury securities account; processing of transactions in those accounts in connection with securities offering, trading, buy-back, and redemption; transfer of income on securities, etc. in accordance with the terms and conditions of the issuance of, and trading in, securities) are provided under the Guidelines on the Procedure for Interaction between NSD and Issuers.

Bond issuance stages

At the initial stage, the issuer takes a decision to issue bonds, following which the issuer, together with a financial advisor or underwriter, proceeds to making preparations for registration of the terms and conditions of bond issuance (prospectus and bond resolution). The drafting of terms and conditions of bond issuance is one of the most important steps, as bonds will be offered and traded on the stock exchange and serviced by NSD in accordance with their registered terms and conditions.

Documents containing the terms and conditions of bond issuance, as drafted by the issuer for the purposes of bond issue registration, to the extent related to services to be provided by the depository, need to be agreed upon with NSD that will be responsible for mandatory centralized safekeeping of the securities certificate.

At the second stage, the issuer and NSD enter into an issuer account agreement.. A copy of the agreement is submitted to the registration authority for state registration of the securities issue, or (for exchange-traded bonds) to the stock exchange assigning an identification number to the issue.

The next stage is either state registration of the bond issue by the registration authority and assignment of a state registration number to it, or (for exchange-traded bonds or commercial papers) assignment of an identification number to the issue.

Following the state registration of the bond issue or assignment of an identification number to the issue (as the case may be), the issuer prepares and provides NSD with a set of documents required for bonds offering, trading, and redemption in accordance with the Guidelines on the Procedure for Interaction between NSD and Issuers.

Before the offering date, the issuer delivers the bond certificate for the entire issue to NSD for safekeeping. The certificate must be issued in the form required by Federal Law No. 39-FZ dated 22 April 1996 “On the Securities Market”. The certificate template is available here (along with the list of documents to be prepared by the issuer for the purposes of interaction with NSD).

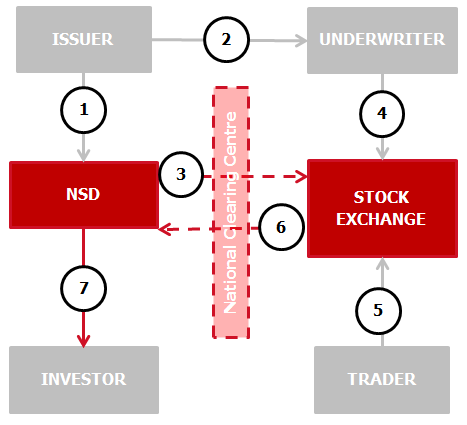

Primary offering of bonds on Moscow Exchange

- The issuer provides NSD with a set of documents required for bond offering (issue-related documents (prospectus and bond resolution), etc.):

- The issuer enters into an issuer account agreement with NSD.

- NSD opens an issuer account for the issuer.

- NSD accepts the bond issue for servicing.

- NSD accepts the bond certificate for safekeeping.

- On the basis of an issuer's instruction (Form MF020), NSD transfers the bonds to the trading sub-account in the issuer account.

- The issuer authorizes the underwriter to issue orders to sell bonds in Moscow Exchange's trading system on behalf of the issuer.

- Trading participants reserve cash funds in their cash accounts with NSD.

- NSD provides information on the quantity of bonds in the issuer's issuer account to NCC, and information on the amount of cash funds reserved in trading participants' cash accounts to Moscow Exchange's trading system.

- The underwriter issues orders to sell bonds in Moscow Exchange's trading system.

- Trading participants who have reserved cash funds in their cash accounts with NSD issue orders to buy bonds in Moscow Exchange's trading system.

- At the close of trading, NCC provides NSD with information on the quantity of bonds to be debited from the issuer's issuer account to the client's securities account. NSD is also provided with information on the debiting of cash funds from the cash accounts of the trading participants whose buy orders were satisfied, and on the crediting of cash funds to the underwriter's cash account.

- NSD uses the information received from NCC to settle the trades.

- NSD uses the information received from NCC to transfer the cash funds from trading participants' cash accounts to the underwriter's cash account.

- The underwriter transfers the cash funds received as a result of the bonds offering to the issuer's bank account.

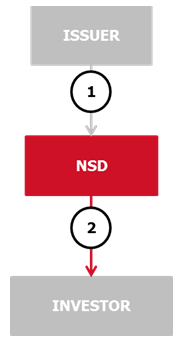

Primary private offering of bonds

FOP delivery under matching instructions:

- The issuer provides NSD with a set of required documents, delivers the certificate for safekeeping, and gives an instruction (Form MF010) to transfer bonds from the issuer's issuer account to the buyer's securities account.

- NSD transfers the bonds from the issuer's issuer account to the buyer's securities account.

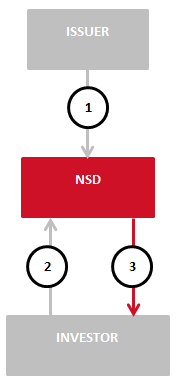

DVP transfer:

- The issuer provides NSD with a set of documents required for bond offering (issue-related documents (prospectus and bond resolution), etc.):

- The issuer enters into an issuer account agreement with NSD.

- NSD opens an issuer account for the issuer.

- NSD accepts the bond issue for servicing.

- NSD accepts the bond certificate for safekeeping.

- The issuer gives an instruction (Form MF170) to transfer the bonds to the client's securities account.

- The client gives to NSD:

- an instruction (Form MF170) to transfer the bonds from the issuer's issuer account to the client's securities account;

- a payment instruction to transfer cash funds from the client's cash account with NSD to the issuer's cash account with NSD.

- NSD takes the following steps:

- Matches the securities transfer instructions of the issuer and client against the client's payment instruction.

- Transfers the bonds from the issuer's issuer account to the client's securities account.

- Transfers cash funds from the client's cash account to the issuer's cash account.

NSD as withholding agent

In accordance with Federal Law No. 39-FZ "On the Securities Market" and Articles 214.1 and 310 of Part Two of the Russian Tax Code (the "Law"):

- Income on all securities subject to mandatory centralized safekeeping is paid by issuer through the CSD. The CSD transfers income to its clients, including nominee holders who pay out the money to their own clients down the chain, until the money achieves the beneficial owner.

- Depositories act as withholding agents when paying out income on securities to individuals and Russian non-residents holding an owner securities account with those depositories.

- No list of securities holders of record for the purpose of income payment is compiled. Income is paid out to the client in whose securities account the securities were held as at the date determined in accordance with the bond resolution and the applicable laws.

- The issuer may receive a list of securities holders from the CSD for a fee which must not exceed the cost of compiling the list (once a year), and in all other cases for a fee set out in the agreement with the CSD.

Accordingly, income transfer is an integral part of depository services provided by depositories to their clients. The Law applies to bond issues with a registration/identification number assigned after 1 January 2012, as well as to any federal government securities subject to mandatory centralized safekeeping, regardless of their registration date.

For bond issues with a registration/identification number assigned before 1 January 2012, the procedure for compiling a list of securities owners and/or nominee holders of record, delivering the list to the issuer and paying agent, and paying out income remains the same, i.e. as provided for by the issue-related documents.

For bond issues with a registration/identification number assigned prior to 1 January 2012, NSD acts as paying agent and as such provides the full range of services, including the following:

- Calculation and transfer of distributions upon an issuer's instruction.

- Providing the issuer with a report on the distributions paid.

- Providing interested persons with information on the dates and terms and conditions of coupon income and redemption proceeds payments; providing reports to persons authorized to receive coupon income and redemption proceeds.

Benefits offered by NSD as paying agent for bond issues with a registration/identification number assigned prior to 1 January 2012

NSD compiles information on recipients of bond distributions. Transfer of such information to the issuer and then to a third party (another paying agent) may result in data corruption or loss, which will be avoided where NSD acts as paying agent.

Disintermediation in the distributions payment process helps cut costs for compiling and delivering a list of securities holders of record entitled to receive bond distributions, thanks to which the record date and the coupon income payment date are as close as possible.

NSD's paying agent services are provided under the paying agent services agreement between NSD and the issuer.

Fees charged by NSD for its paying agency services have been competitive for many years and do not exceed the market level of fees charged by other paying agents. The Fee Schedule for NSD's Services under Paying Agent Services Agreements with Bond Issuers is available here.

Interaction between an issuer and NSD in connection with the acceptance of an exchange-traded bond issue for servicing with a certificate and issue-related documents in electronic format

- The issuer provides Moscow Exchange with a set of documents required for assignment of an identification number to the bond issue (Moscow Exchange's contact tel.: +7 495 363-32-32).

- The issuer provides NSD with a set of documents required for the bond offering:

- The issuer delivers to NSD a certificate in electronic format (PDF) signed with the digital signature of the issuer's CEO or with the digital signature of an issuer's authorized employee (where the bond issue is offered as part of an exchange-traded bond program).

To sign the certificate with a digital signature, right-click the PDF icon of the certificate and select "Sign".

The certificate must be sent via Luch as an untyped document (with the size of the file(s) not exceeding 10 Mb) to the following address: NDC000IAD000.

The deadlines for delivering a certificate are shown in the table below:

* where R is the offering start date (the deadline is to be calculated in business days)Document Form Deadline Certificate

(where bonds are offered other than under a bond program)Original No later than

(R-5)*Certificate

(where bonds are offered under a bond program)Original No later than 11:00 am on (R-2)* - The issuer submits to NSD the document forms required for bond offering in accordance with the Guidelines on the Procedure for Interaction between NSD and Issuers.

Form Z1.1 must be sent via Luch as an untyped document to the following address: NDC000IAD000.

For bond offerings on the stock exchange:

The issuer gives an instruction to open a trading sub-account in the issuer's issuer account (Form AF090, transaction code 90) via Luch (unless a trading sub-account already exists).

The issuer gives an instruction to transfer the securities within the same account (Form MF020, transaction code 20) via Luch.

For bond offerings in the OTC market:

The issuer gives an instruction via EDI channels to transfer the bonds to securities accounts of NSD's clients (transaction code 10 or 16/2). In case uses 16/2, for NSD to make the transfer, a matching instruction with transaction code 16/3 is required.

- The issuer delivers to NSD a certificate in electronic format (PDF) signed with the digital signature of the issuer's CEO or with the digital signature of an issuer's authorized employee (where the bond issue is offered as part of an exchange-traded bond program).