Automatic cash and securities transfers between NCC and NSD.

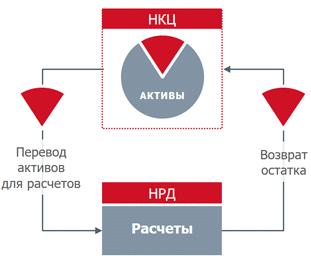

Moscow Exchange offers the automatic transfer service for cash and securities transfers between NCC and NSD clearing houses. The idea behind the service is to concentrate assets at NCC where they could be used not only to settle trades, but also as collateral either for open trades or for making new trades. For the purposes of settlement of trades to be cleared by NSD, the required amount of assets will be allocated. Cash funds or securities received from counterparties in trades cleared by NSD will be returned to NCC.

Thanks to the service, clients benefit from time and funding cost savings.

The service is fully customizable depending on the client's business specifics: it is possible to automate transfers either in one direction only or in both directions and either for one or more than one asset/account, and to choose a time schedule and calculation method for transfers. The Single Account service allows clients to adjust their settings on-the-fly (e.g., to remove any securities issues/accounts from the scope of automatic transfers).

Clients

- Dealers involved in proprietary trading in the on-exchange or OTC market segments

- Brokers who segregate clients' assets and make B2B trades

| ISSUES |

SOLUTION: SOLUTION:«Single Account» |

BENEFITS |

|

|

|

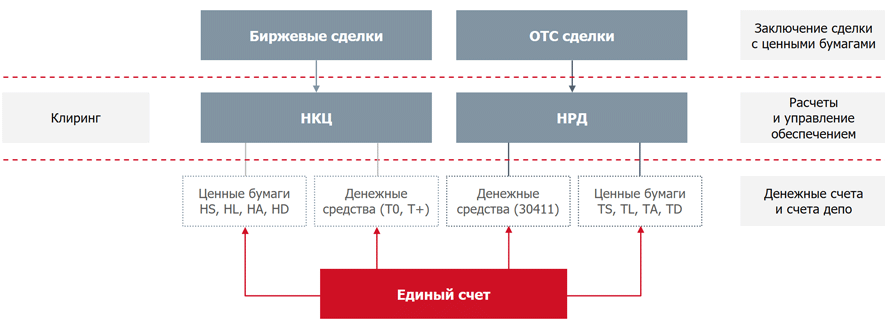

How does the Single Account operate?

Clients' cash funds and securities are concentrated at NCC.

For the purposes of settlement of OTC trades at NSD, assets are allocated from the client's accounts with NCC.

As soon as OTC trades are settled, assets are automatically returned to the accounts with NCC.

It is possible to use only some parts of the service: NSD->NCC or NCC->NSD transfers; securities transfers or cash transfers.

Problem addressed by the Single Account service

The law requires that clients open a separate trading account with each clearing house, which impairs the effectiveness of on-exchange and OTC trades to be settled on a DVP basis.

Automatic cash transfers:

| Service | Transfer direction | Quantity of securities to be transferred | When is a transfer made? | How to activate the service? | Fee |

|---|---|---|---|---|---|

Liquidity management |

NSD -> NCC |

Options:

|

Options:

|

Give instruction 18/ROUT (cash transfers from NSD to NCC) |

NSD charges the standard fee applicable to internal transfers between bank accounts |

Liquidity management |

NCC -> NSD |

Опции:

|

Either before the clearing session, or before the settlement of the DVP1 trade, or before the cash margin settlement |

|

NSD charges the standard fee applicable to internal transfers between bank accounts |

Securities transfers:

| Service | Transfer direction | Quantity of securities to be transferred | When is a transfer made? | How to activate the service? | Fee |

|---|---|---|---|---|---|

Standing instruction for securities transfers |

NSD -> NCC |

Options:

|

Options:

|

Give a standing instruction for securities transfers |

NSD charges the standard fee applicable to book-entry transactions (similar to client's regular transactions) |

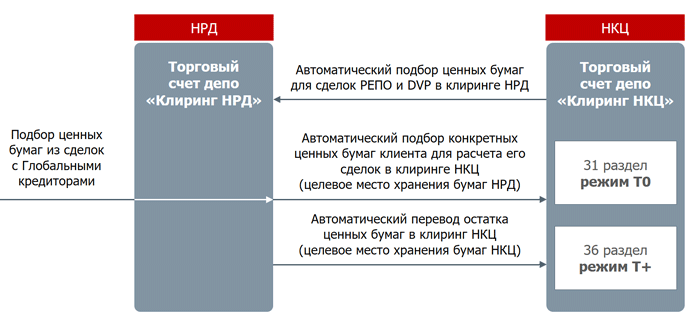

Securities allocation for clearing at NCC |

NSD -> NCC |

Quantity of securities to be delivered by the client to the central counterparty, less the securities balances in client's sub-accounts 36 and 31 |

At 16:45, before NCC's clearing session |

Securities marking for 'Clearing by NCC' |

RUB 240, regardless of how many securities issues are transferred |

DVP settlement with securities allocation |

NCC -> NSD |

Quantity of securities to be delivered by the client to the counterparty, less the securities balance in the client's account |

Either before NSD's clearing session, or before the settlement of the DVP1 trade* |

|

RUB 240 |

Securities allocation for repo trades with a securities basket |

NCC -> NSD |

In the marking line with priority 1, select either the securities with a lesser haircut and a greater value, or the securities indicated at the time of the marking |

Either before NSD's clearing session, or before the settlement of the DVP1 repo trade* |

Securities marking for repo trades:

|

The service is covered by the fee charged for collateral management services |

* With the consent of NCC, only for the quantity of securities that have not been provided as collateral for trades with the central counterparty.