Corporate Actions with Foreign Securities Held in NSD's Omnibus Account with an ICSD

When providing services with respect to foreign securities, NSD arranges for participation of its clients and their customers in corporate actions processed through the ICSDs and foreign Custodians and their agents:

- Euroclear Bank S.A./N.V.;

- Clearstream Banking S.A. /Institutional Shareholder Services Inc.;

- The Bank of New York Mellon.

- CITIBANK N.A. (LONDON BRANCH)

- Central Securities Depository JSC (KACD, Republic of Kazakhstan)

- Republican Unitary Enterprise "Republican Central Securities Depository" (RUE "RCSD", Republic of Belarus)

- Central Depository of Armenia OJSC (CDA, Republic of Armenia)

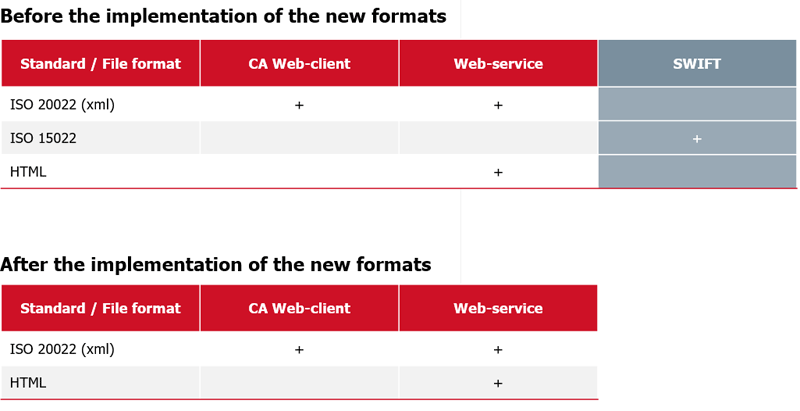

At the early stage of any corporate action, NSD sends notifications to clients with the description of steps to be taken to participate in the corporate action. Notifications are sent in ISO 20022 or ISO 15022 formats via:

- WEB-client;

- Web Service;

- SWIFT.

The more detailed description of the corporate action notification process is available here.

For mandatory corporate actions (MAND), no instructions are required.

Clients may participate in voluntary corporate actions (VOLU), as well as in mandatory corporate actions with options (CHOS), by choosing a preferred option of participation in the corporate action. To do this, the client has to give to NSD a corporate action instruction (68/CAIN) in one of the following formats:

| Standard / File Format | WEB-client | Web Service | SWIFT |

|---|---|---|---|

| ISO20022 (xml) | + | + | - |

| ISO15022 | - | - | + |

Instructions for participation in corporate actions with foreign securities notified using ISO 20022 or ISO 15022 formats may not be given in hard copy. Information on the types of corporate actions notified using ISO 20022 or ISO 15022 formats is available here.

In certain cases, to exercise the rights a client is required to give a universal instruction (transaction code – 68/CAIR0, corporate action type – OTHR).

Where a client wishes to cancel an earlier corporate action instruction, the client must submit a request to NSD for the corporate action instruction cancellation (68/CAIC).

The flowchart that describes interaction between clients and NSD in the course of acceptance and processing of Сorporate Action Instructions and Сorporate Action Instruction cancellation requests is available in the presentation entitled "Processing of CA Instructions and CA Instruction Cancellation Requests for Corporate Actions with Foreign Securities".

Interaction with clients in the course of execution of instructions relating to corporate actions with foreign securities is governed by Guidelines on the Procedure for Interaction between the Depository and Clients in the Course of Performance under the Terms and Conditions of Depository Operations of National Settlement Depository and Electronic Data Interchange.

Message types used for the purposes of Сorporate Action Instruction processing:

| Message Type / Format (Communication Channel) | ISO 20022 (Web-client, LUCH) | ISO 15022 (SWIFT) |

|---|---|---|

| Corporate Action Instruction | CAIN – Corporate Action Instruction | МТ565 |

| Corporate Action Instruction Status | CAIS – Corporate Action Instruction Status Advice | МТ567 |

| Corporate Action Instruction Cancellation Request | CAIC – Corporate Action Instruction Cancellation Request | МТ565 |

| Corporate Action Instruction Cancellation Request Status | CACS – Corporate Action Instruction Cancellation Request Status Advice | МТ567 |

Formats of instructions and other messages to be used in corporate actions with foreign securities are available in the Specifications of Electronic Documents Used by NSD for Corporate Actions Processing.

Examples of instructions and statuses:

| Document name | File | Date published |

|---|---|---|

| ISO 20022 (communication channel: Web-client, LUCH) | 57 kB |

02.06.2016 |

| ISO 15022 (communication channel: SWIFT) | 56 kB |

02.06.2016 |

Requirements to a corporate action instruction

- The instruction must be completed in accordance with the terms and conditions set out in the corporate action notification and additional materials attached to notification.

- The instruction must contain the 6 digit corporate action reference, assigned by NSD.

- For each particular corporate action, each instruction must be assigned a unique number.

- Depending on the corporate action type and terms and conditions, the client may be required to disclose the beneficial owner of the securities, submit further documents, or comply with any other requirements described in the corporate action notification.

- The quantity of securities covered by the instruction must not exceed the quantity of securities available in the securities sub-account with respect to which the instruction is given.

- In each instruction, it is allowed to choose one corporate action option only.

- Instructions must be given with respect to securities sub-accounts and/or sub-registers that are used for keeping of foreign instruments, which are nonclassified as securities under Russian legislation.

- Securities sub-account types for which instructions can be given are as follows:

| Sub-account type | Description | Instruction submission requirements |

|---|---|---|

| 38 | Securities blocked for the purpose of a corporate action | Instructions may be given for 'CERT Tefra D' corporate action only |

| 83 | Securities blocked for corporate actions | Instructions may only be given provided that the terms and conditions of the particular corporate action allow participating in that corporate action* |

| 27 | Securities blocked for the purpose of settlement | Instructions may only be given provided that the terms and conditions of the particular corporate action do not provide for the imposition of any restrictions on the securities participating in the corporate action* |

| R1 | Automatic realignment of foreign securities | Instructions may only be given provided that the terms and conditions of the particular corporate action do not provide for the imposition of any restrictions on the securities participating in the corporate action* |

| 31 36 3A 3C RF RS |

Securities blocked for clearing at NCC Securities blocked for clearing at NCC. Collateral Securities blocked for trading on SPCEX. Stock market segment Securities blocked for trading on SPCEX. REPO transactions with the Bank of Russia Securities blocked for clearing. FORTS Securities blocked for clearing STANDARD |

No specific requirements apply |

| 00 70 73 88 FU NK NU |

Principal sub-account Principal customer's sub-account Principal (additional) sub-account Securities to be distributed to Clients For tax purposes on U.S. securities for QI (U.S. non-residents) Foreign financial instruments not qualified as securities For tax purposes on U.S. securities (U.S. non-residents) |

No specific requirements apply |

| YU | For tax purposes on U.S. securities (U.S. residents) | Instructions may only be given provided that the terms and conditions of the particular corporate action do not provide for the imposition of any restrictions on the securities participating in the corporate action* |

| 5H 7H 8D 8L 8S 8W 9H HC |

Clearing sub-accounts | Instructions may only be given provided that the terms and conditions of the particular corporate action do not provide for the imposition of any restrictions on the securities participating in the corporate action* |

| 10 AR BD IB |

Securities blocked as a result of seizure Securities blocked as a result of seizure at the Client’s depository Securities blocked at the Client’s depository Securities blocked to comply with governmental authorities’ orders/instructions |

Instructions may only be given provided that the terms and conditions concerning the imposition of any restriction allow participating in the corporate action, including by way of exchange or conversion |

* The specific requirements applicable to the process of submission of instructions for this sub-account type are set out in the Guidelines on the Procedure for Interaction between the Depository and Clients in the Course of Performance under the Terms and Conditions of Depository Operations of National Settlement Depository.

If foreign securities participate in a corporate action that involves imposition of restrictions on securities dealing and/or movement and are held on a trading account, securities will be transferred to or from such trading account in connection with a client's Сorporate Action Instruction, provided that the relevant clearing house has given its consent to such transfers in accordance with the clearing house's clearing rules.

Specifics of Corporate Action Instruction and Corporate Action Instruction Cancellation Request Processing

- If the securities available in the sub-account are not sufficient, the client will be notified that the instruction has been rejected;

- Instructions will not be accepted before starting of action period;

- NSD does not warrant acceptance of instructions submitted after the deadline for acceptance of instructions by NSD, and does not warrant participation in the relevant corporate action;

- Information in the instruction must be in English. Instructions that contain either information in Russian or the transliteration attribute (the apostrophe (`) character) will be sent to the foreign depository after their transliteration in accordance with the rules applied by NSD. NSD is not responsible or liable for acceptance/non-acceptance by the foreign depository/issuer/issuer's agent of instructions that contain transliterated information, or for the use of such information in the course of the corporate action processing by the issuer or its agents;

- A line feed character in text fields in instructions is not a divider. To divide text information in different lines, it is necessary to use a blank space either in the end of the first line, or in the beginning of the next line.

- Any information contained in the instruction in the narrative fields will be transmitted to the foreign depository as is, without being validated by NSD. The client shall be responsible for the accuracy and completeness of any such information;

- For the default option of a corporate action or for mandatory corporate actions (MAND), no instructions are required.

- If no instruction is received from the client with respect to a voluntary corporate action (VOLU), no action will be taken on the part of NSD with respect to the relevant securities;

- If no instruction is received from the client with respect to a mandatory corporate action with options (CHOS), the default option will be applied.

- If a corporate action requires that securities are blocked, they are blocked by transferring to sub-account 83 "Securities blocked for corporate actions";

- If securities are blocked on sub-account 83 "Securities blocked for corporate actions" for participation in one corporate action, it is allowed to give instructions for their participation in another corporate action, subject to certain terms and conditions;

- If a record date is set for a corporate action and the terms and conditions of the corporate action require that securities are blocked, and provided that a corporate action instruction was given before the date next to the record date, the securities specified in the instruction will be blocked;

- If no record date is set for a corporate action and the terms and conditions of the corporate action require that securities are blocked, the securities specified in a corporate action instruction will be blocked;

- The instructed securities will remain blocked until the date next to the record date (if any) and/or until the confirmation of unblocking is provided by the relevant Foreign Depository. In certain cases, where no record date is set, the instructed securities may remain blocked until the planned corporate action date;

- If the terms and conditions of the corporate action require that the instructed securities be debited, the blocked securities will be debited, while the securities not accepted to be purchased, either in full or in part, will be unblocked as soon as the confirmation of unblocking is provided by the relevant Foreign Depository;

- Upon receipt of confirmation from the Foreign Depository that securities have been blocked under default option of a mandatory (MAND) or mandatory with choice (CHOS) corporate action, the relevant securities held by Clients may be blocked in NSD by transferring to sub-account 38 "Securities blocked for the purpose of a corporate action";

- The blocked securities will be unblocked by transferring to the sub-account to which the relevant instruction was given (i.e., to the sub-account from which they were transferred to sub-account 83 "Securities blocked for corporate actions"). If it is impossible to identify the sub-account with respect to which the relevant instruction was given, or if that sub-account has been closed, the securities may be transferred to sub-account 88 "Securities to be distributed to Clients";

- Upon cancellation of the instruction, the blocked securities will be unblocked in the same manner as described in the previous paragraph.

If a Client or a Client's customer takes a decision to participate in a Corporate Action by choosing one of the options specified in the Corporate Action Notification, the Client is required to give a Corporate Action Instruction (Form CA331, transaction code – 68/CAIN) in accordance with the Guidelines on the Procedure for Interaction between the Depository and Clients in the Course of Performance under the Terms and Conditions of Depository Operations of National Settlement Depository and subject to the terms and conditions of the Corporate Action.

Please note that the terms and conditions of the Corporate Action may require that the relevant securities be blocked upon giving an instruction. The terms and conditions applicable to the blocking of securities, as well as the requirements to an instruction are available on this web site.

Specific requirements to a Corporate Action Instruction (Form CA331):

--- WEB-client ---

A. For any of the options available in the Corporate Action, it is required to provide, in the 'Contact Details' block, the details of a contact person of NSD's client, who may be contacted if any question concerning the instruction arises. Those details will not be transmitted to the Foreign Depository.

--- SWIFT MT 565 ---

A. For any of the options available in the Corporate Action, it is required to provide, in the '70E:PACO' field, the details of a contact person of NSD's client, who may be contacted if any question concerning the instruction arises. Those details will not be transmitted to the Foreign Depository.

--- ISO 20022---

A. For any of the options available in the Corporate Action, it is required to provide, in the <CorporateAction Instruction/Document/CorpActnInstr/AddtlInf/PtyCtctNrrtv> block, the details of a contact person of NSD's client, who may be contacted if any question concerning the instruction arises. Those details will not be transmitted to the Foreign Depository.

Please note that the terms and conditions set out above are not universal. For more details and the description of the Corporate Action processing process, please refer to communications sent by NSD to its clients who hold securities / non-Russian financial instruments not categorized as securities under the Russian laws in securities accounts/ledgers.

In accordance with the process of a CERT corporate action (TEFRA D Certification for U.S. non-residents), which is a mandatory corporate action with options (CHOS) in the course of which securities holders are required to certify that they comply with the terms and conditions of the securities issue and the applicable U.S. laws, Corporate Action Instructions given to NSD before the deadline for submission of instructions to NSD ("NSD's deadline") will be accumulated by NSD until NSD's deadline, and, as soon as NSD's deadline is reached, those Corporate Action Instructions will be sent to the foreign depository.

The client sends a Corporate Action Instruction (transaction code – 68/CAIN). NSD accepts the instruction and, throughout the instruction processing process, sends relevant reports to the client.

If, by NSD's deadline, no Corporate Action Instructions are received, the quantity of securities held in the securities account/sub-account with respect to which no instructions have been received which certify that the securities holder complies with the terms and conditions of the securities issue and the applicable U.S. laws, will be blocked as soon as NSD's deadline is reached, by their transfer to sub-account 38000000000000006 within the same securities account (transaction code – 10/CA). Upon completion of the transaction, the client will be provided with a report/statement (Form MS101).

Subject to the terms and conditions of the CERT Corporate Action Instructions may also be given after the certification deadline. After the certification deadline the client gives a Сorporate Action Instruction (transaction code – 68/CAIN) from sub-account where uncertified securities are safekept at the moment of instructing. NSD accepts the instruction and, throughout the instruction processing process, sends relevant reports to the client.

An instruction to release securities (transaction code – MF20) must be given to NSD by the client following the receipt by the client of NSD's Corporate Action Instruction Status Advice (68/CAIN-PACK). Upon release of the securities in accordance with the instruction, NSD shall provide the client with a report/statement (Form MS020). Please note that the unique reference of CERT Сorporate Action Instruction 68/CAIN (Form CA331) must be indicated in the Form MF020 instruction to transfer the securities from sub-account 38. If NSD cannot match the details in the instruction to release the securities (Form MF020) against the details in the CERT Сorporate Action Instruction, the securities release instruction may be rejected.

Please note that if a certification instruction is sent after the certification deadline, the client may be charged a fee in accordance with the foreign depository’s fee schedule.

If the client has failed to send Сorporate Action Instruction (transaction code – 68/CAIN), the securities will remain blocked until their redemption.

The more detailed information regarding the process of TEFRA D Certification for U.S. non-residents and the instruction process will be available in NSD's communications addressed to clients holding securities in securities accounts.

In accordance with the new procedure that has taken effect, Euroclear Bank S.A./N.V. does not inform about the possibility to exchange Reg S securities for 144A securities (and vice versa).

Securities holders should, therefore, monitor themselves how and when their securities can be so exchanged in accordance with the provisions of the issue-related documentation. If such an exchange is provided for by the issue-related documents, NSD's client may give a universal instruction to NSD (transaction code – 68/CAIR0).

Please note that the securities for which an exchange instruction is given must be blocked before a 68/CAIR0 instruction is given. The client gives an instruction (transaction type – 20) to transfer the quantity of securities required for the exchange to sub-account 38000000000000015 of the securities account in which the securities are held with NSD. In the 'Basis' section of the instruction, in addition to the list of the relevant documents, the following text must be included: "Transfer of securities for exchange of Reg S securities for 144A securities" or "Transfer of securities for exchange of 144A securities for Reg S securities". For clients whose securities are held in sub-accounts "Securities held in an individual account with EUROCLEAR BANK", preliminary blocking of securities is not required.

A client's exchange instruction must contain the following details:

- Corporate action type – OTHR;

- Corporate action option – SECU;

- Corporate action option number – 001;

- ISIN of the securities to be credited to the client's account as a result of the exchange (to be specified in the 'Additional details' section of the corporate Action Instruction); and

- Contact details of the person giving the instruction to NSD.

NSD reserves the right to request any further information from the client, which could be required for the purpose of execution of the client's instruction at the foreign depository.

Please note that if the requested information is not provided within 5 days following the receipt by the client of the Corporate Action Instruction Status Advice confirming the acceptance of the Corporate Action Instruction by NSD, the Corporate Action Instruction may be rejected.

By exchanging the securities, the client shall be deemed to have acknowledged that the owner of the securities meets all the requirements of applicable law and accepts risks which may arise due to any restrictions in place at the relevant foreign depositories.

In the event of a further request received from the foreign depository, the owner of the securities shall be required to submit a hard-copy certification in accordance with the terms and conditions of the issuance of the securities to be exchanged. The owner of the securities shall bear any risks that may result from the failure to provide required certification.

If NSD receives an instruction with respect to any securities that have not been blocked, NSD reserves the right to reject the instruction. The client will be notified of the rejection in a Corporate Action Instruction Status Advice (transaction code – CAIS). Upon receipt of a client's instruction, NSD will check whether the exchange of securities is possible. Please note that the exchange process may take more than one day.

Based on the request to draw up a list of securities owners / list of persons authorized to exercise rights attached to securities received from KACD, RUE "RCSD", CDA NSD issues a Notification (request for the relevant corporate action) (further- a "Request"). In response to a Request, clients shall in due time disclose information on the securities owners and the persons authorized to exercise the rights attached to the securities by submitting a Form RF005 instruction. More details you can find at page Lists of Securities Owners.

The guidelines on how to connect to Web-client are available here.

No specific steps are required to be taken to connect to any other communication channels.